1. Introduction

If you are the single-member owner of a foreign-owned U.S. LLC, this guide is for you. In this article, we discuss the tax implications that apply to your LLC.

Foreign-owned single-member LLCs are generally treated as disregarded entities for U.S. tax purposes. This means that if you are the sole foreign owner and the LLC has no U.S.-source income or U.S. trade or business activities, the LLC itself is typically not subject to U.S. income tax.

This does not mean that the LLC is not taxable. Instead, the LLC's income is generally taxed in your home country according to your local tax laws and you report any transactions between the LLC and the foreign owner on Form 5472 and 1120 Pro-Forma.

2. Quick Summary — Form 5472 and Pro-Forma Form 1120 Requirements

If you own a foreign-owned single-member US LLC treated as a disregarded entity, you may still have IRS reporting obligations even if you do not owe US income tax.

- Who must file:

- Foreign-owned single-member LLCs classified as disregarded entities for US tax purposes

- Even if the LLC had no reportable transactions you still need to file Form 5472

- Forms required:

- Form 5472 (informational reporting)

- Pro-forma Form 1120 (cover page to submit Form 5472)

- Reportable transactions:

- Capital contributions

- Money movement between owner and LLC

- Incorporation and setup expenses paid by owner

- Distributions and reimbursements

- Filing deadline:

- April 15 each year (calendar-year filers)

- Extension to October 15 via Form 7004

- Submission: Mail or fax.

3. Who This Guide Applies To

This guide is intended for:

- Foreign-owned single-member US LLCs treated as disregarded entities.

- Owners with no U.S. trade or business and primarily informational filing requirements.

This guide does not cover:

- Multi-member LLCs.

- Entities taxed as C corporations.

- Situations involving effectively connected income or complex tax structures.

4. What is a Disregarded Entity?

A foreign-owned single-member LLC that has no U.S.-source income and no U.S. trade or business activities is generally treated as a disregarded entity for U.S. federal income tax purposes. By default, such entities are considered pass-through entities. I say "by default" because you may elect for the LLC to be taxed as a C corporation by filing Form 8832, however that scenario is outside the scope of this article.

A pass-through entity means that, for income tax purposes, the entity's income is treated as the owner's income and is reported on the owner's personal tax return.

Therefore, even though the entity itself may not be subject to U.S. income tax, the income is typically still taxable in the owner's home country under local tax laws and you report the transactions between the LLC and the foreign owner on Form 5472 and 1120 Pro-Forma.

We will discuss more on this later in this article but let's clarify what does no U.S.-source income or U.S. trade or business mean.

5. Do You Have a U.S. Trade or Business?

A U.S. trade or business (USTB) refers to business activities that are actively conducted within the United States and are considered substantial enough to create a taxable presence under U.S. tax law.

While the IRS does not provide a single precise definition, a U.S. trade or business generally exists when a foreign-owned entity engages in regular, continuous, and significant business activities in the United States.

Examples of activities that may create a U.S. trade or business:

- Operating a physical office or place of business in the U.S.

- Having employees or dependent agents working in the U.S.

- Providing services while physically present in the U.S.

Activities that usually do NOT create a U.S. trade or business:

- Owning a U.S. LLC with no active U.S.-based operations.

- Selling digital services from abroad without a U.S. presence.

So even if you have US clients and you serve them from abroad that does not necessarily mean that you have a U.S. trade or business.

Why does this matter?

If a foreign-owned disregarded entity is considered to be engaged in a U.S. trade or business, its income may become Effectively Connected Income (ECI) and could be subject to U.S. taxation and additional filing requirements.

If you are not sure if you have had a U.S. trade or business, please consult a tax professional.

6. Form 5472 and Form 1120 Pro-Forma

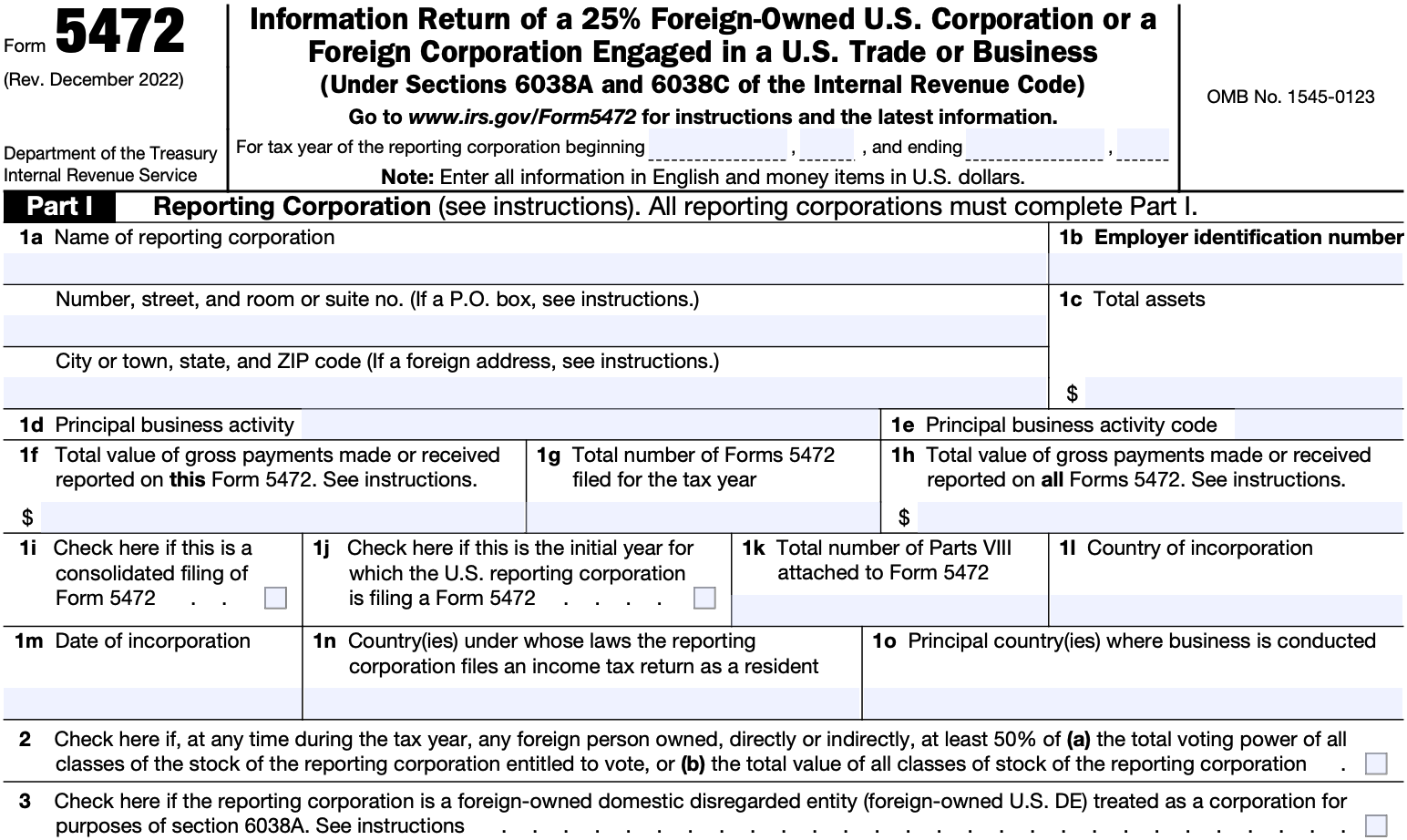

Form 5472 — Informational Reporting

For foreign-owned single-member LLCs treated as disregarded entities, Form 5472 tracks reportable transactions between the foreign owner and the US LLC.

Purpose

The primary purpose of Form 5472 is to disclose financial activity between:

- The foreign owner (or other related foreign parties), and

- The US LLC.

This includes any movement of money or economic transactions between the owner and the company.

Reportable Transactions

Reportable transactions may include:

- Capital contributions from the foreign owner

- Money movements between the owner and the LLC

- Expenses paid personally by the foreign owner on behalf of the LLC

Common Examples

If you formed your LLC and personally paid for:

- Incorporation fees

- Registered agent services

- Formation or setup costs

- Capital contributions and distributions

These transactions are typically reported in Part V of Form 5472 and are described on an attached seperate sheet called a supporting statement.

Pro-Forma Form 1120

Foreign-owned disregarded entities are required to attach Form 5472 to a pro-forma Form 1120.

Purpose

The pro-forma Form 1120 acts mainly as a cover page identifying the reporting corporation.

What is included

- Basic entity details

- Minimal incorporation information

- Selected fields on the first page of Form 1120

Generally, a full corporate tax return is not required unless special circumstances apply.

Supporting Documentation

These filings are commonly accompanied by a supporting statement that:

- Lists all related-party transactions.

- Provides descriptions and breakdowns of amounts reported on Form 5472 Part V.

7. Submission Method

Currently, for foreign-owned single-member LLCs filing Form 5472 with a pro-forma Form 1120, e-filing is not available. As a result, these filings can only be submitted to the IRS using one of the following methods:

- Mail, or

- Fax

After completing the forms, they must be signed and dated before being sent to the IRS through one of these submission methods.

8. Ways to Complete the Filing

There are generally three options:

1. Hire a Tax Professional

A qualified tax professional can review your specific situation and handle the entire process end-to-end, ensuring compliance and accuracy.

2. Do It Yourself (DIY Filing)

You can prepare the forms yourself using IRS instructions. After completing and signing the documents, they can be sent to the IRS by mail or fax.

3. Use Online Softwares

Online softwares like foreignfile.tax allow you to answer guided questions and automatically generate the required forms. You can then download, sign, and submit the documents to the IRS.

9. Form 5472 Filing Deadline

Foreign-owned single-member LLCs required to file Form 5472 with a pro-forma Form 1120 must generally submit their filings by April 15 each year.

This deadline applies to informational reporting for the previous tax year and is aligned with the standard US business tax filing calendar.

When Is Form 5472 Due?

The due date is:

👉 April 15

By this date, you must either:

- Submit Form 5472 together with the pro-forma Form 1120, or

- File an extension request.

Extension for Form 5472 Filing

Foreign-owned LLCs may request a 6-month extension by filing Form 7004 with the IRS.

If the extension is submitted on time:

👉 The filing deadline is extended from:

April 15 → October 15

10. Final Thoughts

Foreign-owned single-member LLCs treated as disregarded entities may not always be subject to U.S. income tax, but they still have important IRS reporting requirements.

Knowing when Form 5472 and a pro-forma Form 1120 are required, how to report transactions between the foreign owner and the LLC, and understanding concepts such as disregarded entity classification, U.S. trade or business activities, and reporting deadlines can help foreign owners better navigate U.S. tax compliance requirements and avoid penalties.

11. Disclaimer

This article is provided for informational and educational purposes only and should not be considered tax, legal, or professional advice. Every taxpayer's situation is different. You should consult a qualified tax professional or advisor to obtain advice specific to your circumstances before making any tax or filing decisions.